Cryptocurrency markets are known for their volatility, and with this comes the need for traders to have advanced tools at their disposal to manage their trades. Advanced order types are critical in a savvy trader’s arsenal, enabling them to strategize better, protect their investments, and enhance their potential for profit. In this article, we delve into the complexities of these order types, discussing the utilization of stop-loss orders, take-profit orders, conditional orders, One-Cancels-the-Other (OCO) orders, and trailing stops. With these tools, traders can navigate the tumultuous waters of the crypto market with greater confidence and precision.

Exploring Advanced Crypto Order Types

Advanced order types in cryptocurrency trading are mechanisms that enable traders to control their entry and exit points in the market more precisely. Unlike the basic market and limit orders, advanced orders come with extra conditions or features that can help traders capitalize on market movements or protect themselves from significant losses. These order types include stop-loss, take-profit, conditional, OCO, and trailing stop orders. Understanding and effectively utilizing these tools can make a significant difference in a trader’s strategy, ensuring they can react to market changes quickly and with a pre-defined plan.

Navigating Through Stop-Loss Orders

A stop-loss order is a crucial tool for risk management in trading. It allows traders to set a specific price at which their position will automatically sell to prevent further losses if the market moves against them.

- Activation Price: This is the price level at which the stop-loss order becomes active.

- Execution: Once active, the order executes as a market order, selling the asset at the best available price.

- Protection: Stop-loss orders protect against steep declines in asset value by limiting potential losses.

- Placement Strategy: Traders often place stop-loss orders just below key support levels or a percentage below the purchase price.

- Slippage: In fast-moving markets, the final executed price may differ from the set stop-loss price due to slippage.

Stop-loss orders are particularly valuable during bear markets or when a trader cannot monitor their positions regularly.

Mastering the Art of Take-Profit Orders

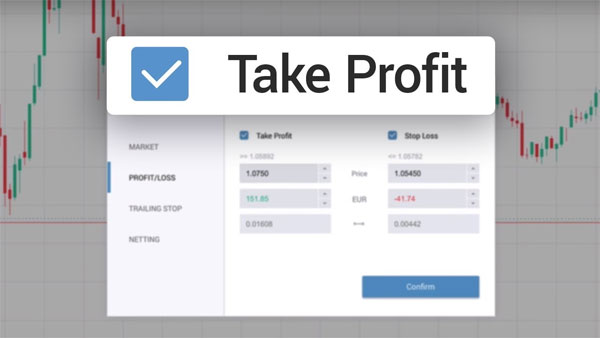

Take-profit orders are the yin to the stop-loss’s yang in trading strategies. They allow traders to set a target price to lock in profits before a potential trend reversal occurs.

- Objective: The primary goal is to secure profits at a predetermined price level.

- Price Setting: Traders often set take-profit orders at historical resistance levels, or use technical indicators to identify potential target prices.

- Automation: Like stop-loss orders, take-profit orders automatically execute as market orders once the target price is reached.

- Strategy: Combining stop-loss and take-profit orders can create a balanced trade management strategy.

- Emotion Control: By setting take-profit orders, traders can avoid the psychological trap of becoming greedy and hoping for even higher prices.

Take-profit orders help in executing a disciplined trading strategy by ensuring that profits are realized and not lost to sudden market downturns.

Unveiling Conditional Orders’ Power

Conditional orders are advanced order types that are executed only if certain conditions set by the trader are met. These can be based on price, time, or the execution of other orders.

- Flexibility: Conditional orders offer traders flexibility to plan for various market scenarios.

- Complex Strategies: They allow the implementation of complex trading strategies that can be contingent on multiple factors.

- Market Entry: Traders can use conditional orders to enter the market at more favorable prices rather than entering at the current market price.

- Chain Reactions: Conditional orders can trigger a series of trades automatically, based on the initial conditions met.

- Types of Conditions: These can include price points, the execution of other trades, or even time-based conditions.

Conditional orders are a valuable tool for traders who wish to automate their trading strategies and react to market conditions swiftly.

The Role of OCO in Crypto Trading

One-Cancels-the-Other (OCO) orders are a combination of two orders, typically a stop-loss and a take-profit order, where the execution of one automatically cancels the other. This tool is instrumental in trade management.

- Simultaneous Planning: OCO orders allow traders to simultaneously plan for both favorable and unfavorable market moves.

- Risk Management and Profit Targets: They combine the protective features of stop-loss orders with the profit-securing benefits of take-profit orders.

- Singular Execution: Only one of the two orders can execute, ensuring that the trade is exited for either a predetermined loss or gain.

- No Need for Constant Monitoring: OCO orders offer peace of mind as the trader does not need to be constantly watching the market.

- Strategy Execution: They are particularly useful in volatile markets where quick reactions to price movements are critical.

OCO orders are essential for traders who want to ensure that their exit strategies are in place regardless of how the market moves.

Leveraging Trailing Stops for Gains

Trailing stop orders are designed to protect gains by enabling a trade to remain open and continue to profit as long as the price is moving in a favorable direction, but automatically close the trade if the price changes direction by a certain percentage or dollar amount.

- Dynamic Nature: Trailing stops move with the market price at a set distance, allowing for potential profit maximization.

- Automatic Adjustments: The stop level adjusts automatically as the price moves, locking in profits.

- Downside Protection: Protects against market downturns without setting a limit on potential gains.

- Customization: Traders can set trailing stops based on a specific percentage or a dollar amount away from the market price.

- Market Exit: Once the market price hits the trailing stop level, the order converts to a market order to close the position.

- Hands-Off Approach: This order type is ideal for traders who prefer a set-and-forget strategy that automatically adjusts to price movements.

Trailing stops are a powerful tool for traders aiming to ride a trend for as long as possible while safeguarding the accrued profits.

Comparison Table for Advanced Order Types

| Order Type | Purpose | Action Trigger | Advantage | Potential Disadvantage |

|---|---|---|---|---|

| Stop-Loss | Limit Losses | Price reaches a set level | Protects capital | May execute at a worse price due to slippage |

| Take-Profit | Secure Profits | Price reaches a set level | Guarantees profits | May limit potential gains if price continues to rise |

| Conditional | Execute trades under certain conditions | Specified conditions are met | Enables complex strategies | May not execute if conditions are not met |

| OCO | Manage entry/exit simultaneously | One order executes, the other cancels | Plans for multiple outcomes | Can miss potential profits or limit losses |

| Trailing Stop | Protect Gains | Price changes direction by a set amount | Maximizes potential profits | Could be stopped out in a volatile but overall profitable market trend |

Advanced order types in crypto trading provide traders with the functionality to fine-tune their strategies, manage risk, and potentially increase profits. From the protective measures of stop-loss orders to the profit-locking mechanisms of take-profit orders, the flexibility of conditional orders, the duality of OCO, and the dynamic nature of trailing stops, these tools are indispensable in the complex world of cryptocurrency trading. By understanding and adeptly applying these advanced order types, traders can navigate the market with a well-equipped toolkit, ready to tackle the challenges and seize the opportunities that the volatile crypto landscape presents.